Amphenol’s $10.5 Billion Power Move: What the CommScope CCS Acquisition Means for the Future of Connectivity

Amphenol Corporation has announced a landmark deal in the wire and cable industry. The company is acquiring CommScope’s Connectivity & Cable Solutions (CCS) business unit for $10.5 billion. The transaction is expected to close in early 2026. It marks Amphenol’s largest acquisition to date. The deal positions Amphenol as a dominant force in broadband, data center, and enterprise infrastructure markets.

But this deal is more than a financial headline—it’s a clear reflection of where the industry is headed, what’s driving demand, and how key players are gearing up to meet it.

What’s Included in the Amphenol – CommScope’s Connectivity Deal?

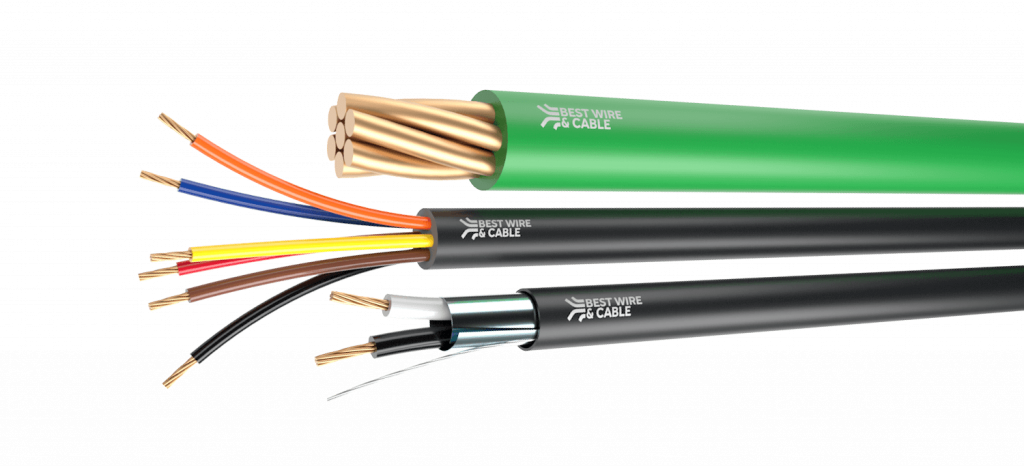

CommScope’s CCS unit is one of the most recognized names in network cabling, with a robust portfolio that includes:

-

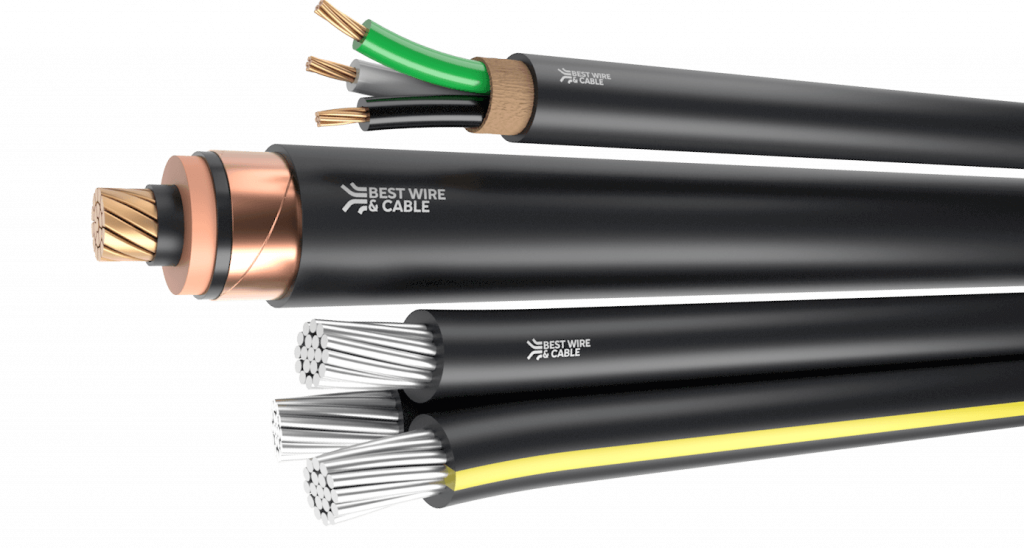

Fiber-optic and copper cable systems

-

Connectors, panels, and enclosures

-

Structured cabling for enterprise networks

-

High-performance solutions for broadband service providers

-

Infrastructure for hyperscale data centers and edge computing

The CCS business generated approximately $3.5 billion in revenue in 2024, serving a global customer base across telecommunications, commercial buildings, and government.

For Amphenol, this acquisition doesn’t just add revenue—it unlocks a massive global footprint, expanded customer relationships, and the ability to scale fiber and copper solutions in high-growth areas.

What’s Driving This Acquisition in Amphenol?

Three major trends are fueling this strategic move:

The Rise of AI Infrastructure

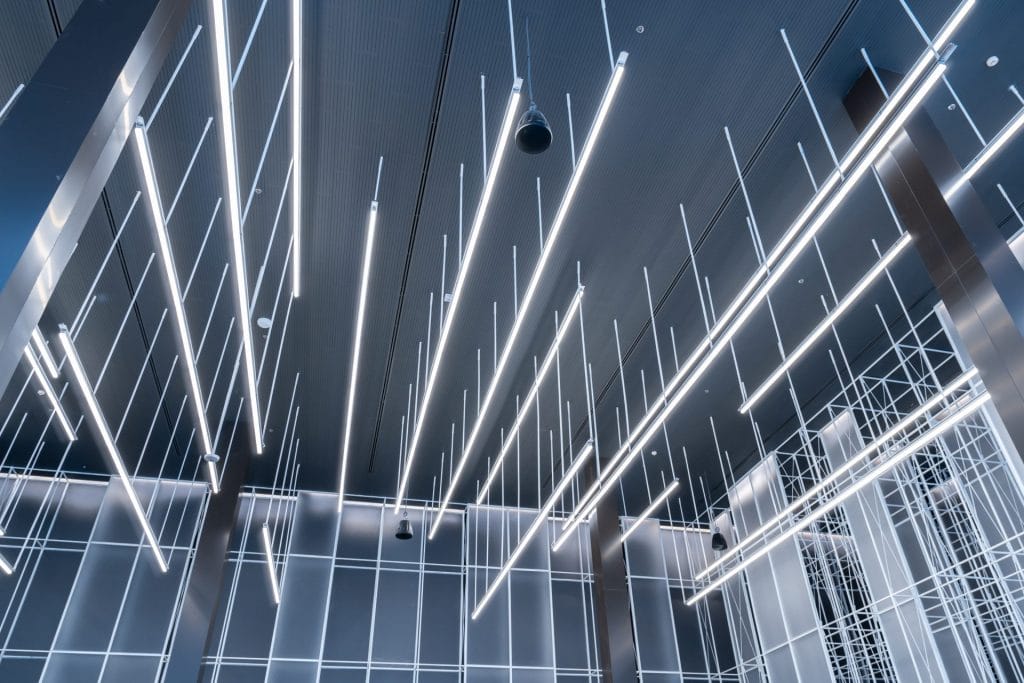

The explosion of artificial intelligence, particularly large language models and generative AI, is putting unprecedented demands on data center infrastructure. AI workloads require high-density fiber connectivity, low-latency switching, and massive bandwidth.

5G and Edge Deployment

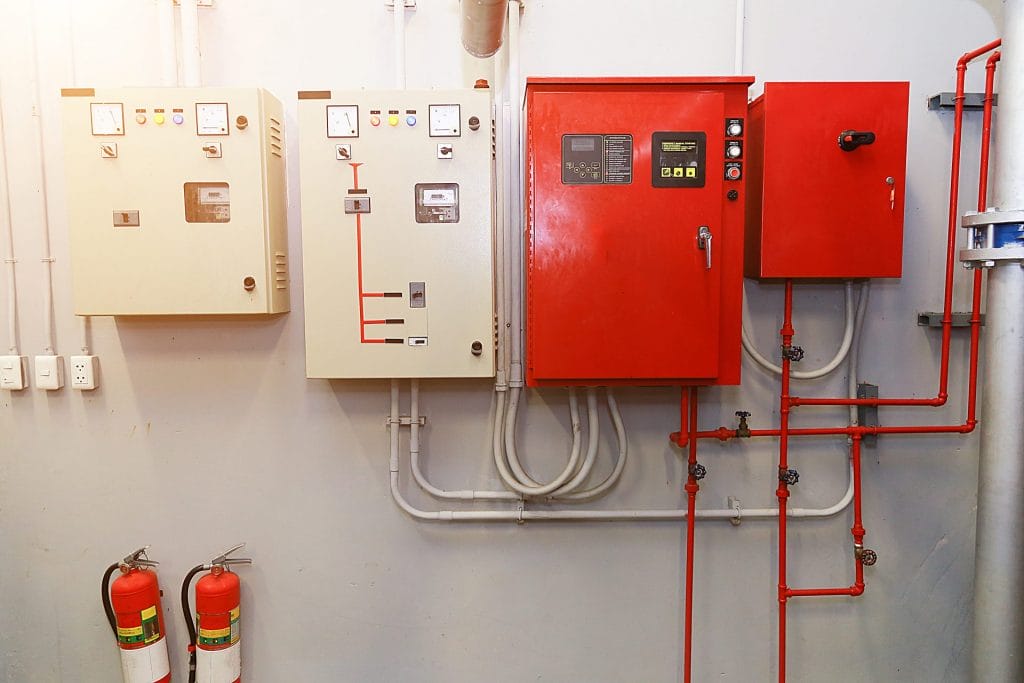

Telecom providers are racing to roll out 5G networks and edge computing infrastructure. Both rely heavily on fiber-to-the-premises (FTTP) and copper backhaul to ensure speed and reliability. CommScope’s CCS unit brings years of experience in outdoor connectivity, small cell enclosures, and high-reliability cabling. These strengths align closely with Amphenol’s ambitions.

Convergence of IT and OT

From smart buildings to industrial automation, the lines between IT (information technology) and OT (operational technology) are blurring. This merger enables Amphenol to offer unified cabling solutions for digital buildings, campus networks, smart factories, and beyond.

Why It Matters for the Industry

This deal isn’t just about one company getting bigger — it has implications for OEMs, distributors, contractors, and end users across the wire and cable landscape.

-

Consolidation = Streamlined Offerings

Customers can expect tighter integration between components, faster lead times, and more comprehensive product suites under the Amphenol umbrella. -

R&D Firepower

With CCS’s engineering talent and product development pipeline, Amphenol gains a powerful innovation engine—especially important in a time when low-loss fiber, advanced shielding, and thermal efficiency are key. -

Pricing Leverage & Supply Chain Control

By absorbing CCS’s supply base, Amphenol strengthens its position in raw material sourcing, logistics optimization, and channel management. This could bring more stable pricing and product availability for customers hit by past disruptions.

What Happens Next?

Pending regulatory approvals and standard closing conditions, the deal is expected to finalize in Q1 of 2026. Integration will likely take much of 2026 and into 2027, but Amphenol has a strong track record of acquisition efficiency—having successfully integrated TE Connectivity’s Broadband Network Solutions, FCI, and other major brands in the past.

CommScope, meanwhile, will use the proceeds to reduce debt and refocus its strategy on wireless infrastructure and home networking.

The Bottom Line

Amphenol’s acquisition of CommScope’s CCS unit is more than a megadeal—it’s a statement. A statement that the future is fiber, that AI and 5G are no longer “next”—they’re “now”, and that infrastructure players must evolve quickly to support the digital economy.

For businesses in the wire and cable sector, this is a signal to:

Reevaluate partnerships and supply chains

Prepare for product line shifts and integration updates

Anticipate greater fiber and broadband demand in every sector—from utilities to universities