How Global Demand Is Reshaping U.S. Cable Lead Times and Manufacturing

In 2025, the wire and cable industry is feeling the effects of unprecedented global demand. Renewables, electrification, data centers, utility upgrades, and EV infrastructure are all driving demand for copper and cable products higher than ever. As a result, lead times for U.S. cable manufacturers have stretched, production capacity has been challenged, and companies increasingly rely on multiple suppliers to manage risk and meet project timelines.

Understanding these dynamics is essential for contractors, distributors, and project planners facing longer wait times and rising costs.

Global Demand Is Rocketing — and It Affects the U.S. Supply Chain

The demand for copper — the core material in most electrical cable — is surging globally. According to global market data, total copper wire demand reached around 21.5 million tons in 2024, driven by power distribution projects, construction, and expanding industrial applications. 360 Research Reports

On top of that, global investment in power grid expansion is outpacing copper supply, with worldwide infrastructure investment expected to exceed $400 billion in 2025. These projects require massive amounts of copper for transmission, distribution, and renewable energy builds. Reuters

Copper demand for electrical and power infrastructure alone is forecast to grow significantly between 2025 and 2030, with billions of additional tons needed for modern grid systems and emerging applications like EV networks and data centers. expometals.net

This broad, structural demand surge creates intense pressure on refiners and cable makers — and those pressures pass down the supply chain to U.S. manufacturers and contractors.

U.S. Manufacturing Struggles With Capacity and Lead Times

The U.S. wire and cable manufacturing sector is relatively small compared with domestic demand. In 2025, the U.S. cable manufacturing industry is estimated at about $16 billion, yet it operates with chronic undercapacity. Regulations.gov

Domestic lead times have grown dramatically. For instance, medium-voltage cable made in the U.S. now often requires five to six months lead time, which is more than double the typical pre-pandemic cycle. Regulations.gov These extended wait times can halt or delay critical infrastructure and construction projects.

In part, this is because U.S. producers have limited scale — roughly 282 companies employing around 23,000 workers are expected to serve a nation of 330 million people. Regulations.gov Raw material shortages and labor constraints further slow production, pushing manufacturers to ration capacity across high-demand segments like MV/HV cable, utility distribution, and industrial wiring.

Copper Market Pressures Amplify Cable Lead Times

Copper is the dominant conductor material in U.S. wire and cable manufacturing, accounting for a significant share of raw material usage. Industry Research

However, global copper markets are strained due to multiple overlapping demand drivers:

-

Renewable energy buildouts, grid upgrades, and data center expansions are increasing copper consumption. 360 Research Reports+1

-

Analysts warn of supply deficits, with refined copper supply potentially not keeping pace with demand as early as 2025. Tom’s Hardware

-

Some forecasts claim total demand could exceed supply by 30% by 2035 if current trends continue. The Guardian

Even when supply isn’t technically short on a global basis, regional bottlenecks and stockpiling can make metals harder to access locally, especially in the U.S. Recent export redirections show major commodity traders diverting copper shipments away from Asian markets and toward U.S. ports — a signal that demand pressures are influencing trade patterns. Reeling Cable

These copper market dynamics drive up prices and lengthen lead times for cable manufacturers who must secure raw materials before production can even begin.

Extended Cable Lead Times Impact Projects Across Sectors

Longer lead times affect every part of the electrical supply chain:

-

Utility and grid modernization projects face schedule risk when MV/HV cable orders slip.

-

Renewable energy developers can’t energize solar or wind farms until cables arrive.

-

Data center and industrial builds may have high electrical infrastructure on the critical path.

-

EV charging network deployments require complex cable assemblies that are caught in the same backlog.

Where lead times once averaged 8–12 weeks, they now span 8–52 weeks for certain medium-voltage products. Regulations.gov This dramatic extension requires contractors and planners to rethink how they manage supply chains and project timelines.

The Importance of Having Multiple Suppliers

In this environment of supply constraints and global competition for raw materials, relying on a single supplier can pose significant risk. Here’s why multiple suppliers matter:

Mitigating Risk

Different suppliers have different inventories, production capacities, and access to raw materials. Having options can protect projects from single-source breakdowns.

Shorter Lead Time Opportunities

If one manufacturer’s lead time stretches months, another may offer shorter delivery or alternative material options, helping keep projects on schedule.

Pricing Flexibility

Global price volatility — such as copper rising toward historic highs due to demand, tariffs, or geopolitical pressures — means pricing from a single supplier can spike unexpectedly. Alternatives help manage cost exposure. AP News

Geographic Resilience

Some suppliers may operate closer to project sites or in regions less affected by specific global disruptions, reducing transportation risk and delay.

Practical Strategies for Cable Procurement

To navigate these challenges effectively, industry professionals should:

-

Forecast cable needs early in project planning.

-

Build relationships with diversified suppliers, both domestic and international.

-

Consider alternative materials or cable designs where standards allow.

-

Negotiate flexible contract terms that include guaranteed lead times or priority allocation.

-

Monitor commodity markets, especially copper pricing and expected deficits.

These practices help maintain continuity even when global demand surges.

Final Thoughts

Global demand for copper and cable materials is reshaping lead times, manufacturing capacity, and supply chain strategy in the U.S. As electrification, renewable energy deployment, data infrastructure, and grid upgrades drive unprecedented usage, U.S. manufacturers grapple with limited capacity and longer production schedules. Expanding supplier networks, planning ahead, and diversifying sourcing strategies are no longer optional — they are essential risk management tools that keep projects moving in a high-demand world.

Resources & References

-

Copper Wire and Cable Market Size & Trends (360 Research Reports) 360 Research Reports

-

Cable Material Market Growth and Drivers (FMI) globenewswire.com

-

Wire & Cable Manufacturer Lead Time Data (IBISWorld) Regulations.gov

-

Global Copper and Grid Trends (ExpoMetals) expometals.net

-

Copper Cable Market Dynamics and Raw Material Challenges Industry Research

-

Reuters: Global Infrastructure Drives Copper Demand Reuters

-

Analyst Warning on Copper Deficit in 2025 Tom’s Hardware

-

Global Copper Demand Outlook by IEA The Guardian

-

Reuters: Copper Price Pressures and Trade Dynamics Reuters

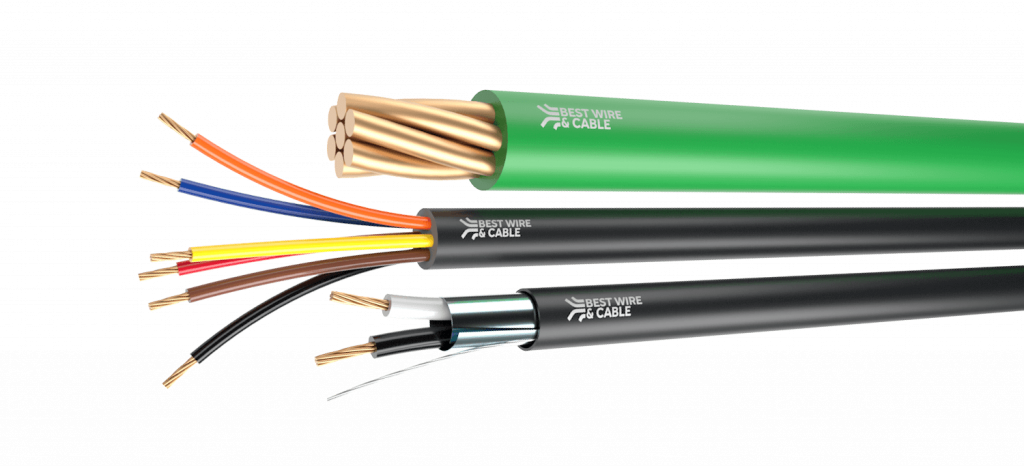

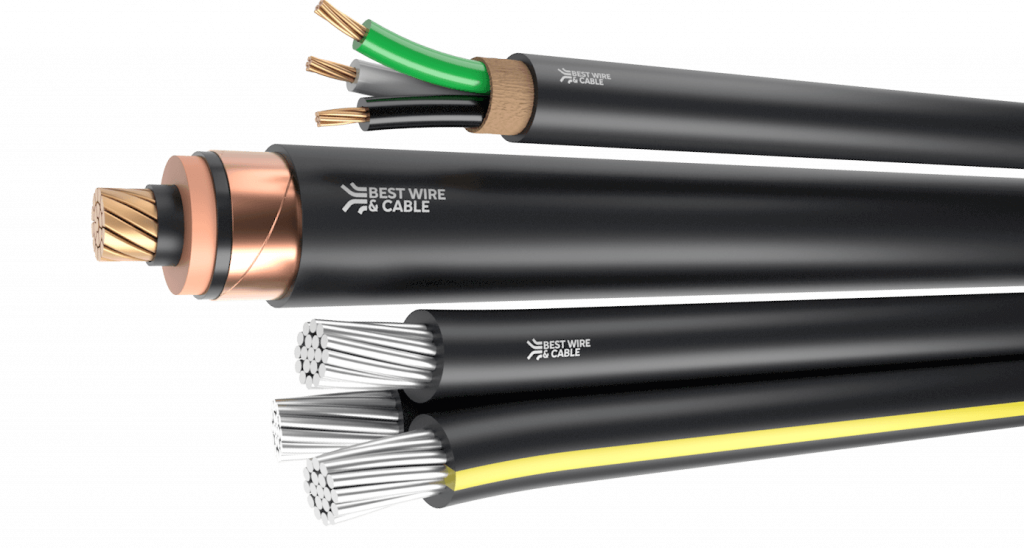

Click to see our Products