The Surge in Copper-Clad Steel Wire Adoption: Driving the Future of Connectivity

The global wire and cable industry is experiencing a significant shift, and copper-clad steel (CCS) wire is at the center of it. Traditionally overshadowed by solid copper, CCS is now seeing unprecedented demand across multiple sectors. With applications spanning telecommunications, renewable energy, smart grids, and railway electrification, this hybrid conductor is proving to be both practical and cost-effective.

According to market analysis, the CCS wire market is set to grow from USD 2.43 billion in 2024 to USD 4.19 billion by 2033, representing a 6.3% CAGR. Some forecasts place the broader CCS market even higher, with values reaching USD 29.4 billion by 2033. This surge reflects the growing recognition of CCS as a versatile solution for today’s infrastructure challenges.

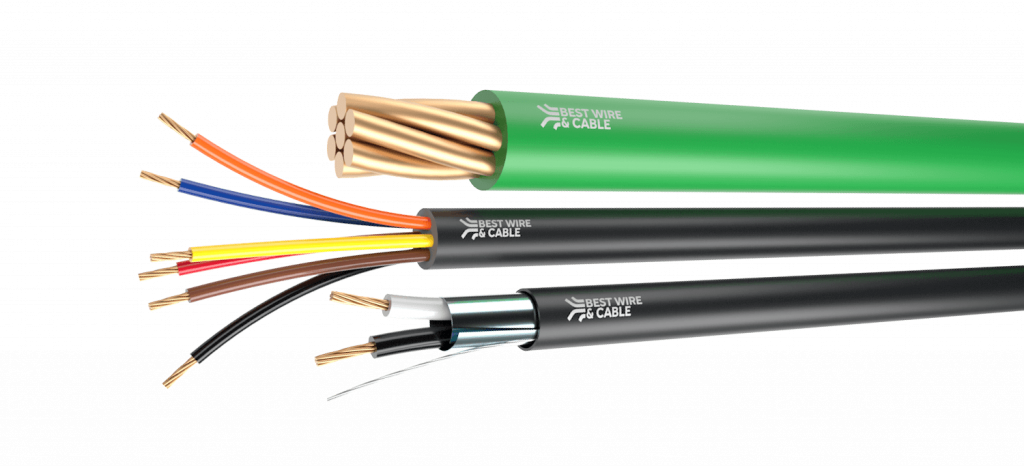

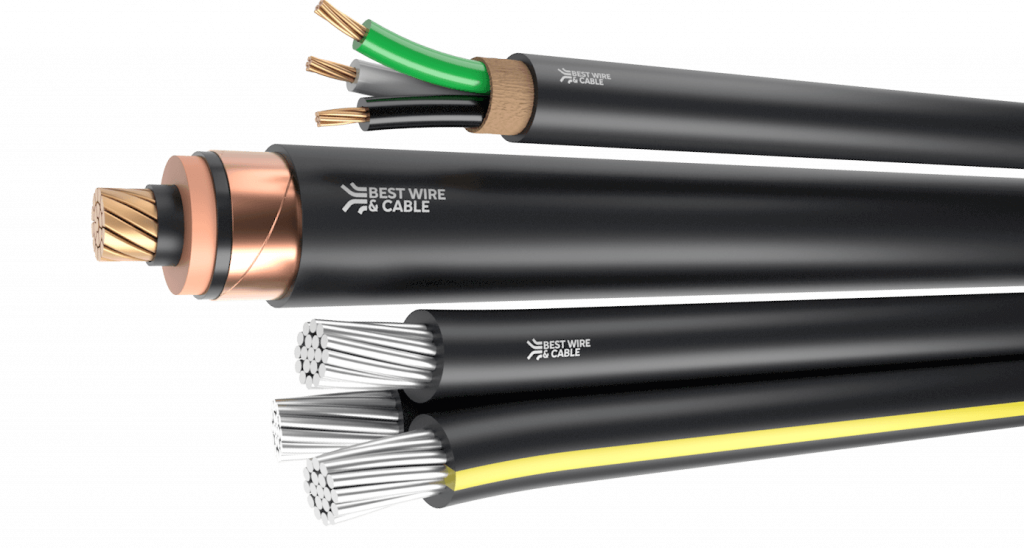

What is Copper-Clad Steel Wire?

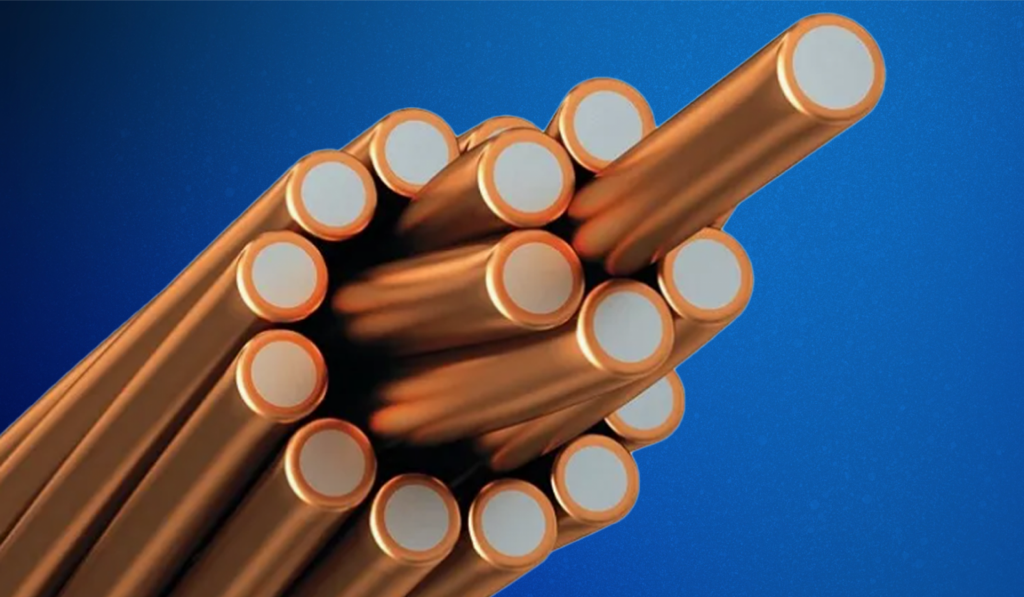

Copper-clad steel combines the conductivity of copper with the tensile strength of steel. It is manufactured by bonding a layer of copper around a steel core, ensuring excellent electrical performance while reducing material costs.

CCS typically delivers around 40% of the conductivity of pure copper, but it makes up for this with strength, corrosion resistance, and cost savings. These properties make it ideal for large-scale installations where durability and theft resistance are also priorities.

Why Demand is Surging

Telecommunications and 5G Deployment

The rollout of 5G infrastructure is one of the biggest factors fueling CCS adoption. Towers, antennas, and grounding systems all benefit from CCS’s high tensile strength and conductivity. Reports indicate that CCS already accounts for 72% of telecom tower grounding applications worldwide, showing its strong foothold in the sector.

Renewable Energy Expansion

As the world moves toward cleaner energy, solar farms and wind projects increasingly use CCS for grounding and transmission lines. The wire’s durability in outdoor conditions makes it well-suited for long-term renewable energy installations. Studies show CCS is present in over 66% of solar projects, reflecting its growing role in sustainable infrastructure.

Smart Grids and Power Transmission

Modern electrical grids are evolving into smart grids, designed for resilience and efficiency. CCS supports these systems with strong grounding networks and reliable performance in high-voltage environments. Its lower scrap value compared to copper also reduces theft risk, a major advantage for utilities.

Railway Electrification

Railway systems, particularly in Asia and Europe, are increasingly electrified. CCS is used in overhead grounding wires, substations, and signal systems, offering strength and stability under heavy mechanical stress.

Cost Advantages

Copper prices remain volatile, making CCS a strategic alternative. Priced lower than solid copper, CCS helps manufacturers and infrastructure projects reduce material costs while maintaining performance. With copper prices hovering between $3.50 and $4.50 per pound, CCS offers long-term savings.

Market Outlook and Regional Trends

The growth of CCS is not evenly distributed across regions.

-

North America currently accounts for about 41% of global CCS consumption, driven by telecom upgrades and renewable projects.

-

Europe holds around 27%, with demand coming from railway electrification and green energy mandates.

-

Asia-Pacific represents 23% of the market, fueled by rapid 5G adoption and massive infrastructure investment in countries like China and India.

By 2033, analysts project CCS will play a critical role in virtually all major infrastructure sectors.

Leading Companies Driving Innovation

Several key players dominate the CCS market:

-

Fushi Copperweld – Expanding global production capacity.

-

AFL – Developing CCS solutions for marine and harsh environments.

-

Nexans – Partnering with telecom providers to accelerate 5G deployment.

-

General Cable, Southwire, and Superior Essex – Innovating with advanced coatings and stranded CCS products for longer lifespans and better conductivity.

These companies are not only expanding production but also enhancing the durability, consistency, and performance of CCS wire through advanced manufacturing processes.

Emerging Applications

Beyond traditional uses, CCS is gaining traction in:

-

Automotive and EV charging infrastructure – Lightweight, durable grounding conductors for charging stations.

-

Aerospace and defense – High-performance conductors in harsh environments.

-

Smart cities and IoT networks – Reliable cabling for connected infrastructure.

These emerging markets demonstrate CCS’s versatility and adaptability to evolving technological needs.

Conclusion: A Growing Force in the Wire and Cable Market

The surge in copper-clad steel wire adoption is more than just a cost-saving trend—it represents a strategic shift in global infrastructure. With applications in telecom, renewable energy, smart grids, and transportation, CCS offers the perfect balance of conductivity, strength, durability, and affordability.

As global demand for connectivity and clean energy continues to rise, CCS will remain an essential player in meeting those challenges. From 5G towers to solar farms and railway lines, copper-clad steel is powering the future.

Want to learn more about wire and cable solutions shaping modern infrastructure? Click below for expert insights and products designed to meet your project’s needs.